,

First Time Home Buyer 401k Withdrawal 2024

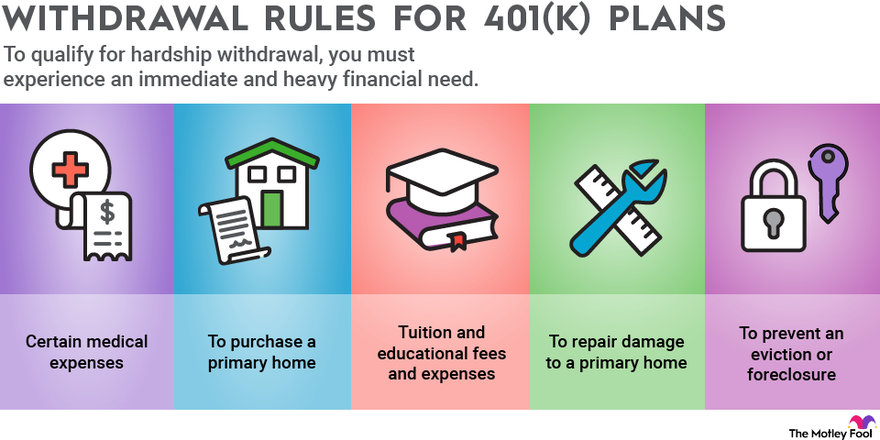

First Time Home Buyer 401k Withdrawal 2024 – Experts generally advise against using your retirement savings to fund a home purchase. You could incur a 10% penalty as well as any income taxes owed on the 401(k) withdrawal. If you get a 401(k) . A HUGE change could be coming in the Chancellor’s Spring Budget in a major boost for first-time buyers. Jeremy Hunt is reportedly mooting the idea of cutting the Lifetime ISA (LISA) penalty .

First Time Home Buyer 401k Withdrawal 2024

Source : www.fool.comNew IRA & 401K Early Withdrawal Rules Starting in 2024 | Early

Source : m.youtube.comRules for 401(k) Withdrawals | The Motley Fool

Source : www.fool.comRoth IRA: Benefits, Rules, and Contribution Limits 2024

Source : districtcapitalmanagement.comBest 401(k) Plans Of 2024 | Bankrate

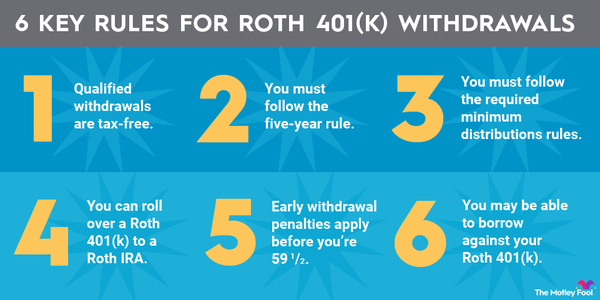

Source : www.bankrate.com6 Things to Know About Roth 401(k) Withdrawals | The Motley Fool

Source : www.fool.comIRA Required Minimum Distributions Table 2023 2024 | Bankrate

Source : www.bankrate.com6 Things to Know About Roth 401(k) Withdrawals | The Motley Fool

Source : www.fool.comAt What Age Can I Withdraw Funds From My 401(k) Plan?

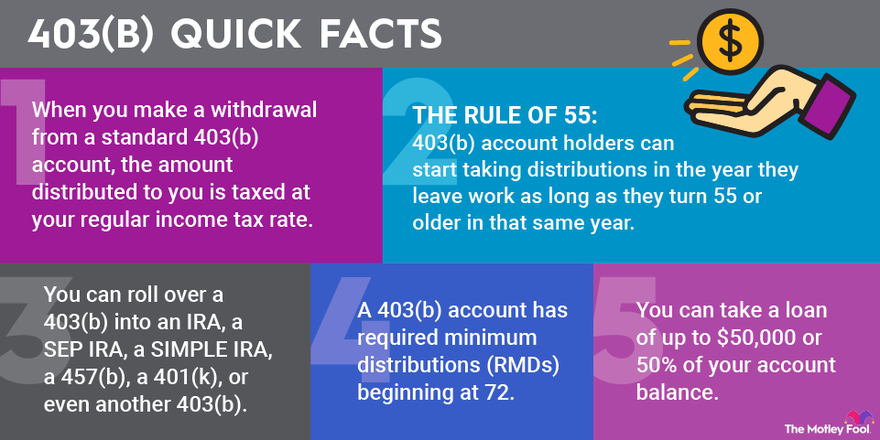

Source : www.thebalancemoney.com403(b) Withdrawal Rules for 2024 | The Motley Fool

Source : www.fool.comFirst Time Home Buyer 401k Withdrawal 2024 6 Things to Know About Roth 401(k) Withdrawals | The Motley Fool: LONDON — Jeremy Hunt is on a mission to woo first-time homebuyers. The U.K. chancellor is considering shaking up the Lifetime Individual Savings Account, or LISA, in a ploy to get more people on the . ISAs to help first-time buyers save a deposit are becoming increasingly ineffective because of outdated restrictions and rising house prices, experts have warned .

]]>

:max_bytes(150000):strip_icc()/what-age-can-funds-be-withdrawn-from-401k-abd801d6dbd343309cf738f1fa2c621c-6724ec42ef6141c8bc59e3404bcda89b.jpg)