,

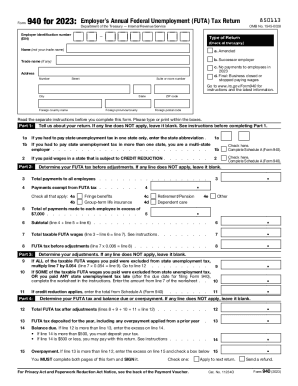

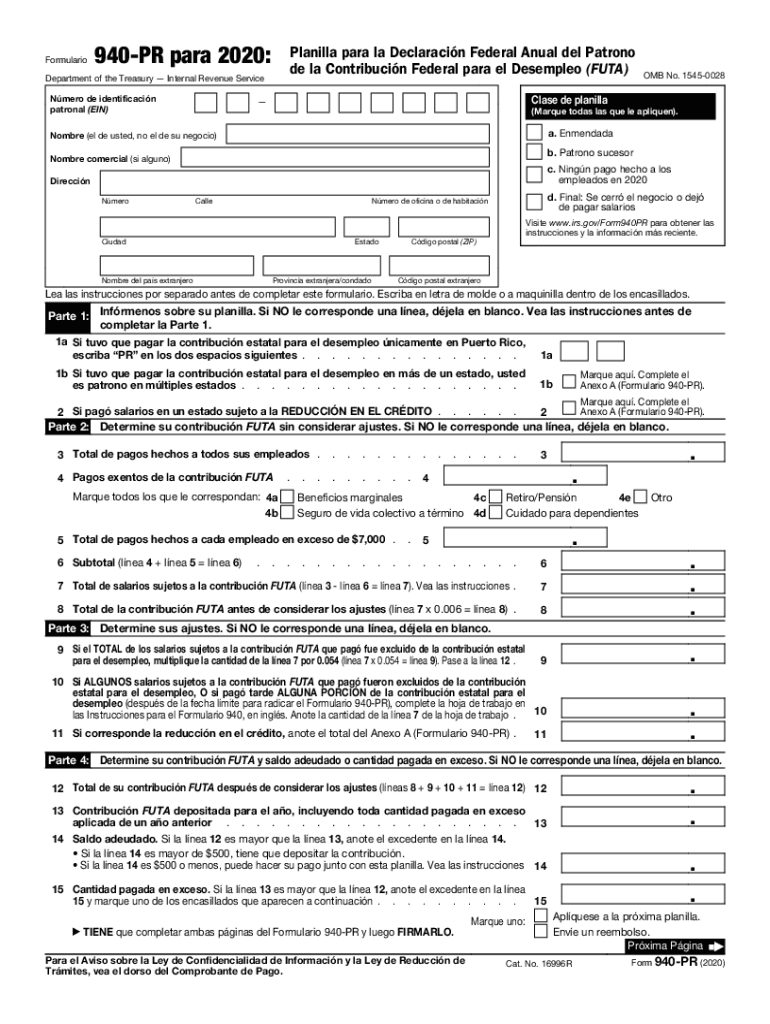

Form 940 For 2024

Form 940 For 2024 – After an employee surpasses $7,000 in income, the employer can stop paying FUTA tax on them. Form 940 is the tax form that employers use to report their FUTA taxes. Although it covers the entire . Form 944 is filed annually and is due January 31st of the following year. IRS Form 940, the Federal Unemployment Tax Return, is required annually. The filing date is January 31st of the following .

Form 940 For 2024

Source : www.forbes.com2024 IRS Form 940: Annual Federal Unemployment BoomTax

Source : boomtax.comForm 940 and Form 941: Big IRS Updates for 2024

Source : blog.boomtax.comForm 940 Instructions (2024 Guide) – Forbes Advisor

Source : www.forbes.comForm 940 and Form 941: Big IRS Updates for 2024

Source : blog.boomtax.comneed help lifting business suspension Google Business Profile

Source : support.google.comForm 940: What Is It and How Do I Fill It Out Superior Trucking

Source : www.truckingpayroll.com✨ JANUARY DEADLINE INFORMATION! ✨ What is due January 31, 2024

Source : m.facebook.comDisapproval of My Google for Nonprofit Application Google for

Source : support.google.com940 form: Fill out & sign online | DocHub

Source : www.dochub.comForm 940 For 2024 Form 940 Instructions (2024 Guide) – Forbes Advisor: 2. Complete and submit IRS Form 940 for Federal Unemployment Tax (FUTA). Employers must pay FUTA if they either paid $1,500 or more in employee wages during any calendar quarter of the previous year . The Federal Unemployment Tax Act requires employers to file IRS Form 940 annually to report the paying of their FUTA taxes. IRS Form 940 generally must be filed in the first quarter of the year. .

]]> More Details

/cdn.vox-cdn.com/uploads/chorus_image/image/72389517/SuperMarioRPG_scrn_01.0.jpg)

/cdn.vox-cdn.com/uploads/chorus_image/image/73150670/usa_today_21163795.0.jpg)

/cdn.vox-cdn.com/uploads/chorus_image/image/73097173/usa_today_21088730.0.jpg)

/cdn.vox-cdn.com/uploads/chorus_image/image/73045244/1234357719.5.jpg)

/cdn.vox-cdn.com/uploads/chorus_image/image/73124171/1242212640.0.jpg)

ac-june-2024.png?sfvrsn=53b8a3a0_2)